Long term investing in the United States stock market is not about predicting the next headline or chasing momentum. It is about identifying businesses with durable value that the market has temporarily mispriced. While short term traders focus on price action long term investors focus on probability discipline and time. The U.S. market offers a unique advantage in this regard due to its regulatory transparency deep liquidity and global economic influence.

The New York Stock Exchange and the NASDAQ provide access to thousands of publicly listed companies across every major industry. Within this vast universe most investors struggle not because opportunities are rare but because noise is constant. News cycles social media speculation and emotional reactions often overshadow fundamentals. A well defined strategy helps cut through that noise and allows investors to make decisions based on logic rather than impulse.

This article presents a structured long term stock selection strategy designed specifically for the U.S. stock market. The approach focuses on identifying companies that are profitable undervalued relative to earnings and positioned for long term growth. Rather than relying on complex formulas or speculative narratives this framework uses simple repeatable filters combined with thorough due diligence.

The strategy emphasizes valuation discipline using price to earnings ratios historical trading ranges and cash flow analysis. It also incorporates legal and regulatory checks to avoid hidden risks. Importantly this approach does not attempt to time the market precisely. Instead it seeks to stack probabilities in favor of the investor by buying quality businesses at prices that offer a margin of safety.

This framework is particularly suitable for investors who prefer a buy and hold philosophy and who understand that meaningful returns are built over years not weeks. While no strategy is immune to risk a disciplined process significantly improves decision making consistency and long term outcomes. By the end of this article you will understand not only how the strategy works but why each step exists and where its strengths and weaknesses lie.

Image

The Structure of the U.S. Stock Market

The U.S. stock market is the most liquid and regulated equity market in the world. The New York Stock Exchange is dominated by established corporations with long operating histories strong institutional ownership and relatively stable earnings. These companies often represent mature industries such as finance manufacturing consumer goods and energy.

The NASDAQ exchange is known for innovation oriented sectors including technology biotechnology communications and advanced manufacturing. While many NASDAQ listed companies are large and profitable the exchange also includes firms at earlier stages of development with higher growth potential and higher volatility.

This strategy focuses on companies listed on the NYSE and the primary NASDAQ market because these exchanges require regular financial disclosures audited reporting and adherence to regulatory standards enforced by the Securities and Exchange Commission. Avoiding poorly regulated markets reduces exposure to fraud illiquidity and unreliable financial data.

Image

Core Investment Philosophy

At the heart of this strategy is the belief that markets are efficient over the long term but frequently inefficient in the short term. Prices often reflect fear uncertainty or temporary business challenges rather than permanent impairment. These mispricings create opportunities for patient investors.

Instead of predicting future growth stories this strategy relies on observable facts. Earnings cash flow historical prices and legal standing are measurable variables. By anchoring decisions to data investors reduce emotional bias and increase consistency.

Another key principle is selectivity. Owning fewer well researched stocks often leads to better outcomes than owning many poorly understood ones. Concentration combined with discipline allows investors to monitor holdings effectively and respond appropriately to changes in fundamentals.

Step 1: Building a Broad Candidate Universe

The process begins with gathering data from reputable sources such as major financial publications exchange websites and professional stock screeners. The goal is to identify U.S. listed companies that meet basic criteria such as profitability sufficient trading volume and transparent reporting.

At this stage investors should avoid forming opinions. The purpose is to create a neutral starting pool that can later be refined using objective filters.

Image

Step 2: Price to Earnings Ratio as a Valuation Anchor

The price to earnings ratio serves as a primary valuation filter in this strategy. By focusing on companies with a ratio of five or lower the investor targets businesses that are priced conservatively relative to current earnings.

Such low valuations often occur when companies face temporary challenges sector wide downturns or negative sentiment. While not all low valuation stocks are good investments this filter ensures that price expectations are already subdued which improves margin of safety.

It is important to note that this step excludes many popular growth stocks. This is intentional. The strategy prioritizes risk adjusted returns over maximum upside.

Step 3: Understanding the Fifty Two Week Trading Range

The fifty two week high and low provide context for how the market has valued a stock over the past year. This range captures multiple market environments including optimism pessimism and neutrality.

By examining where the current price sits within this range investors gain insight into sentiment. Stocks trading near lows may be overlooked or misunderstood while those near highs may already reflect optimism.

Step 4: Measuring Upside Using Historical Lows

Multiplying the fifty two week low by two provides a simple test for historical upside potential. If the resulting figure remains below the fifty two week high the stock demonstrates that the market has previously supported higher prices without extreme valuation expansion.

This step filters out stocks whose upside appears structurally limited based on historical behavior.

Step 5: Confirming Value Using Current Price

Repeating the same calculation with the current closing price adds an additional layer of discipline. If doubling the current price still falls below the historical high the stock remains attractive from a valuation perspective.

This condition ensures that investors are not buying stocks that have already completed their recovery.

Step 6: Focused Watchlist Creation

After these filters the investor is left with a small manageable group of candidates. This is where effort shifts from screening to understanding.

A focused list allows for deeper analysis stronger conviction and better monitoring over time.

Legal and Regulatory Risk Assessment

Legal issues can destroy shareholder value regardless of financial strength. Lawsuits regulatory penalties or accounting irregularities can permanently impair a business.

Reviewing filings with the Securities and Exchange Commission helps identify these risks early. Transparency is a non negotiable requirement for long term investing.

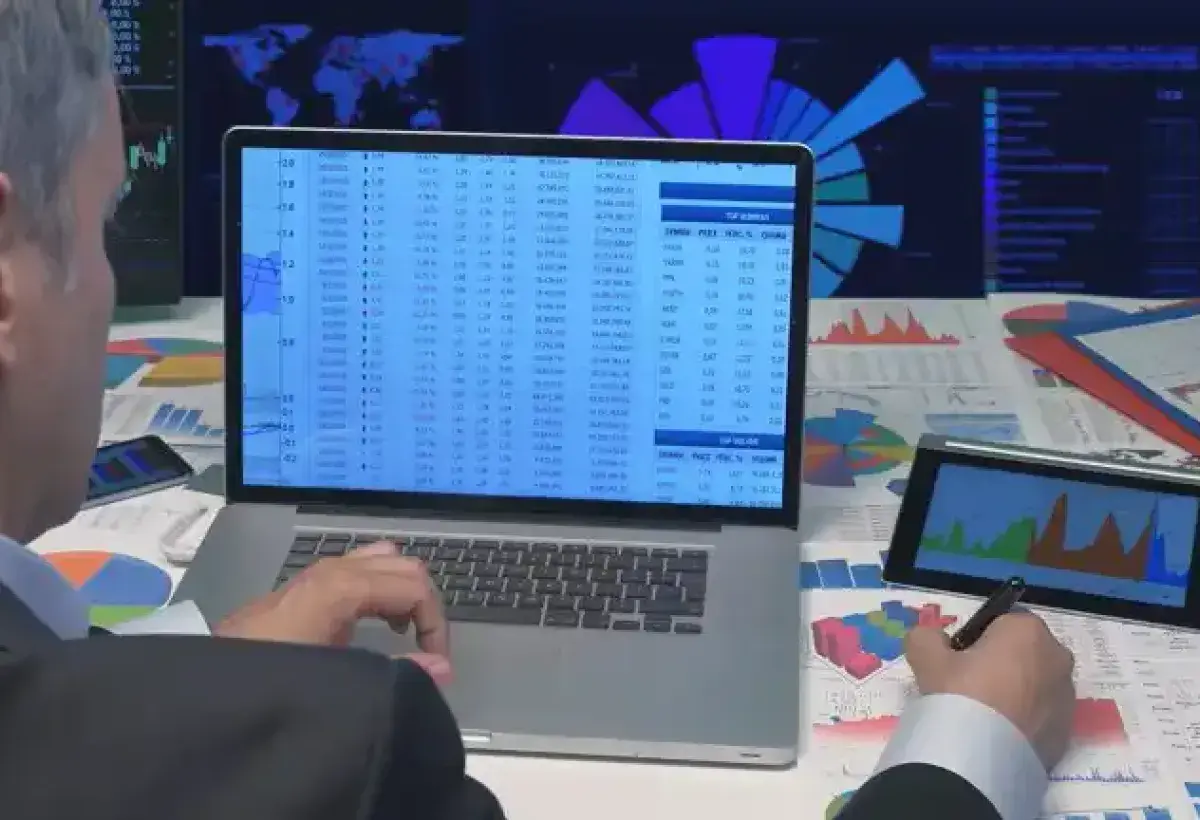

Financial Health and Cash Flow Analysis

Earnings can be influenced by accounting choices but cash flow reveals operational reality. Strong operating cash flow indicates that a company can sustain itself invest in growth and weather downturns.

Balance sheet strength debt levels and liquidity ratios further inform risk assessment. A company with low valuation but weak financial health may be a value trap.

Image

Business Model and Management Quality

Numbers alone do not tell the full story. Investors must understand how the company makes money its competitive position and the quality of leadership.

Strong management teams allocate capital wisely communicate transparently and adapt to changing conditions. Businesses with durable demand and competitive advantages are more likely to realize long term value.

Observation Period and Market Behavior

Allowing time to observe price behavior before buying helps avoid impulsive decisions. Short observation periods reveal volatility patterns and market sentiment.

This step reinforces patience and prevents emotionally driven entries.

Execution and Portfolio Construction

Position sizing should reflect risk tolerance and diversification goals. Investing across several qualified stocks reduces company specific risk while maintaining focus.

Buying even lots aligns with traditional market practices and ensures liquidity.

Long Term Holding and Compounding

The final step is commitment. This strategy is designed to benefit from time. Short term volatility is expected and should not prompt reaction unless fundamentals deteriorate.

As companies grow they may initiate dividends conduct stock splits or transition into more stable valuation profiles.

Advantages of This Strategy

This approach emphasizes discipline valuation and risk control. It reduces emotional decision making and avoids speculative markets. It encourages thorough research and patience.

By focusing on profitability and cash flow it aligns with long term capital preservation and compounding.

Limitations and Risks

No strategy is perfect. Low valuation stocks may face structural decline. Historical price ranges do not guarantee future recovery. The strategy may underperform in momentum driven markets.

It also requires patience discipline and independent thinking which many investors struggle to maintain.

Image

Long term success in the U.S. stock market is rarely accidental. It is built through process discipline and the ability to remain rational when others are emotional. The strategy outlined in this article provides a structured framework for identifying undervalued profitable companies with the potential for long term growth.

By combining valuation filters historical pricing analysis legal due diligence and financial health assessment investors can dramatically improve decision quality. While the strategy does not promise perfect timing or guaranteed returns it emphasizes margin of safety and thoughtful execution.

Investors should view this framework as a foundation rather than a rigid rule set. Markets evolve industries change and businesses adapt. Continuous learning and periodic review are essential.

The greatest strength of this strategy lies not in any single metric but in its mindset. Investing becomes intentional measured and repeatable. Over time this approach can help investors build confidence consistency and sustainable wealth in the U.S. stock market.

Investment Disclaimer

The information presented in this article is provided for general educational and informational purposes only. It does not constitute financial investment legal or tax advice and should not be interpreted as a recommendation to buy sell or hold any security or financial instrument.

All investment strategies involve risk including the potential loss of principal. Past performance of any company or investment strategy is not indicative of future results. Market conditions economic factors and company fundamentals can change at any time and may impact investment outcomes.

The strategy discussed reflects a personal analytical framework focused on publicly available information within the United States stock market. It is not tailored to the financial situation risk tolerance or investment objectives of any individual reader. Investors should conduct their own independent research and analysis before making any investment decisions.

Readers are encouraged to consult with a qualified financial advisor broker or other licensed professional before acting on any information contained in this article. The author and publisher make no representations or warranties regarding the accuracy completeness or suitability of the information provided and disclaim any liability for losses or damages arising from its use.

Opinions expressed are those of the author and are provided for general information only. They do not represent investment advice or endorsements of any securities.